Crash on Stage 3 & Why Smart Businesses Still Win the Energy Race

The Big Beautiful Bill and What it Means for Onsite Energy Projects

There’s something magical about the Tour de France. For three weeks every July, I follow the race like a Hawk, watching the best athletes in the world grind it out through mountains, crosswinds, crashes, and controversy.

This isn’t just a bike race. It’s 184 elite riders across 23 teams with multimillion-dollar sponsorships on the line. They race more than 3,339 kilometers over 21 brutal stages, backed by years of preparation. Entire careers are shaped around this one race. Every day is a new battle, and every decision is magnified by pressure from teammates, fans, brands, and the media.

And sometimes…things go sideways. Fast.

Take this week. Alpecin–Deceuninck had a dream start. Their star sprinter, Jasper Philipsen, took the yellow jersey on day one. On day two, his teammate secured the yellow jersey. But by stage three, Jasper was out. He crashed, through no fault of his own: an unfortunate circumstance put him in the hospital, dreams over in a split second. Just like that, the team’s plan was toast.

Except, it wasn’t.

Because the team had seen this happen before. Last year, they had a scare on Stage 3, and it shook them. So they signed another world-class sprinter, Kaden Groves, not as a backup, but as insurance. And now, with Philipsen out, it is expected that Groves will step up and the team will convalesce around a new leader. He’s no longer the support rider. He’s the guy.

That’s what preparation looks like. That’s what it means to play to win.

So why am I telling you this story?

Because right now, in our world of energy and business, some would say we just hit a “Stage 3 crash” moment, and how we respond will define who takes the yellow jersey in the years to come.

Don’t Let Uncertainty Stop You

The “Big Beautiful Bill” just passed in the U.S., and if you read all the press and listen to some of the noise in the market, you’d think it’s time to throw in the towel. Race over!

But that’s not the case.

This isn’t the end. It’s the start of a new phase of the race. Sure, the terrain just changed. Incentives are shifting. Some provisions got trimmed. The confidence of some is knocked. But just like Alpecin–Deceuninck at the Tour, we’ve seen this all before, and change is the only constant.

If you had a singular vision and a static plan, you would be impacted. But if you’ve been building your strategy with eyes open or are open to adapting, you’re in a great position to lead. That’s why I’m still incredibly bullish. Here’s why:

Inevitable Trajectory - The pain points are becoming undeniable. Energy isn’t a nice-to-have; it’s the foundation of your business. As discussed in this article, incentives are great, but they are no longer the metric that makes projects viable or not. If your costs are volatile, your margins are at risk. If your power isn’t reliable, your operations are exposed. If your sources aren’t clean, your stakeholders will push back. The idea that you can outsource your energy strategy and hope for the best? That era is over.

Urgency - The revised landscape creates urgency. For years, companies could afford to wait. Incentives weren’t going anywhere, so there wasn’t much reason to move fast. But as pain points mount, that window is now narrowing. Instead of having tax credits for solar through 2035, they are now available for projects that begin construction within one year of enactment (by 7/4/2026) if placed in service within 4 years, OR begin construction after 7/4/26, they must be put into service by 12/31/2027 to qualify. Businesses that act today will lock in long-term value that is financial, operational, and reputational. Waiting just got expensive.

Innovation - The incentives that matter most are still intact. Battery storage in particular remains a massive opportunity. It’s not just about backup power, it’s about unlocking stacked value: load shifting, demand reduction, grid services, and more. Battery tax credits are protected through 2033. They will increasingly be a key component of onsite energy systems moving forward, where it makes economic and operational sense.

Capital Availability - Capital is no longer a constraint for this market; there is dry powder available to companies who want to secure financing for their projects. That said, one major and very positive update is the reinstatement of 100% bonus depreciation, up from 40% in 2025 and previously set to phase out entirely by 2027. Being able to depreciate onsite energy equipment by 100% in the first year makes the economics of projects even more compelling. Done right, behind-the-meter systems aren’t a sunk cost; they’re an asset, and access to capital isn’t a barrier to action.

Process Efficiency - The soft costs that have plagued our industry, such as high origination costs, unclear processes, fragmented solutions, long procurement timelines, interconnection delays, unique contracts for every project, and more, are being streamlined. This, combined with ongoing equipment price reductions, increasing energy costs, outage impacts, and stakeholder pressure (direct penalties, regulatory, contractual, or brand), will more than ensure onsite energy projects are economically viable and extremely valuable vs passive energy consumption from the grid.

To learn all the latest updates in depth, check out a webinar hosted by my co-founder, Dan Roberts.

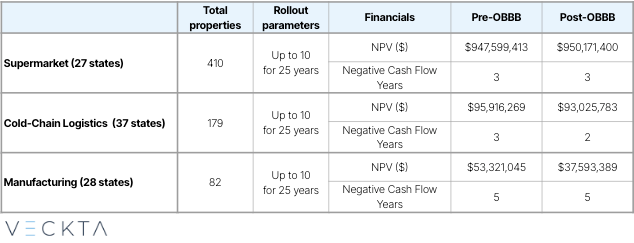

Having utilized the power of our energy analysis and strategy platform, assessing thousands of variables, we looked at three customer profiles with facilities spread across the country. The system determines how to maximize the returns on investment based on the dynamic market conditions and the strategy to deploy them. In this situation, we limited the platform to deploying 10 projects a year, but in many cases, this will not be enough. It looked at what the system sizes and financials would look like pre-Bill, today, and post-2027, and factors in tax credit changes, accelerated depreciation, utility rate escalations, cost reductions for equipment, and so much more. There are two big takeaways:

Project economics are better here in the short term compared to last week, due to tax credits being retained and increasing the bonus depreciation back up to 100%.

Utility cost increases, equipment price reductions, and soft-cost compression soften the impact of solar tax credits' elimination, allowing economics to be sustained.

Considering solar only leaves significant value on the table.

As always, the key is to optimize the system deployed (size, combination of technologies, and operational parameters) to maximize these returns.

Individual Project Examples:

Portfolio Analysis

Note, the NPV numbers are significant, and even in the worst case scenario, the manufacturing company can realize $37M of value and only be cash flow negative for 5 years. The supermarket can realize almost $1B in value with only 3 years of negative cash flow! This is based on pure financials, stack on all the additional value streams and there is no reason not to act, this is our collective fiduciary responsibility.

Embrace Change, Win the Race

It’s easy to get distracted by market noise, political theater, or the latest talking head motivated to spout negativity and create uncertainty. But the fundamentals haven’t changed, the way we power our businesses is changing, and the companies that prepare, not just with hope, but with a real plan, will win.

Onsite energy remains the most powerful way to take control of your energy future. We are advising C&I clients to maximize the opportunity. Unlock long-term savings, resilience, and competitive advantage, regardless of shifting federal incentives. In the next article I will share the optimal way to achieve the best outcomes.

Just as in the Tour, entire careers of the athletes, executives and teams are in the spotlight. Sponsors and key stakeholders expect returns on investment and coverage related to success, riders are seeking legendary status and career-making performances and team members want to be associated with success and be a part of something special.

What I love the most about the tour is that the biggest budgets do not guarantee success, teams with the fewest resources with a well-orchestrated game plan can realize stage wins that will generate returns on investment, memories and legacy for lifetimes to come. The same is true of onsite energy, well made plans, maximizing the opportunities and embracing change will deliver wins today and for years to come.

Stage wins, yellow jerseys and grand tours are still up for grabs. But only for the companies, teams and leaders that are ready to lead, even when the race takes an unexpected turn.

So don’t panic.

Plan. Act. Adapt. And keep pushing forward.

Let’s go.