Beyond The Boardroom

I just returned from several days in the Eastern Sierra backcountry, specifically the Dusy and Palisades Basin, west of Bishop. It was incredible. My mountaineering partner is an investor in VECKTA - it was a perfect illustration of work and personal life meshing. I’m proud of the community that’s being built around VECKTA and our collective mission to improve how we power our world.

My days were filled with quiet and moving one foot in front of the other - with some labored breathing trudging along at 11,000+ feet - giving me time to process the last few weeks of conversations with the market, specifically with commercial real estate asset investors, owners, managers, and advisors. It’s clear that there is a tipping point happening in the appetite for adopting onsite energy and decarbonization investments. It’s still early, but the market is moving and building momentum all the time as the benefits and asymmetric risk opportunities are realized.

The Asymmetric Real Estate Risk Opportunity - From “Concrete Box” to Power Producer

In the rapidly evolving real estate landscape, asset owners and managers find themselves inundated, confused and overwhelmed. Historically, managing physical properties and optimizing for net operating income (NOI) was a more straightforward task: filling the box, maintaining the box, and ensuring a steady stream of rental income. However, today’s world demands much more. Inflation, commoditization, rising energy costs, increasing pressure from tenants and investors for sustainable practices, and the looming specter of weather impacts are reshaping what it means to be successful in real estate.

The real estate industry, responsible for nearly 39% of global greenhouse gas emissions, is now being asked to do more than provide space. It must deliver profitable returns in a challenging economic environment sustainably. The good news is that this shift presents enormous opportunities for those who are ready to embrace the future.

From Cost Center to Profit Center

Energy is at the center of everything—without it, nothing happens. With it, at the wrong price or inconsistently, rolling inflationary pressures are created. Those who own it control everything. Historically, energy has been seen by businesses as a cost center, something landlords had little control over, especially under triple net leases, where tenants bear the brunt of the energy bill. But this dynamic is changing.

Energy costs are rising, grid reliability is decreasing, and there’s growing recognition that buildings can no longer be passive consumers of electricity. As Brendan Wallace, CEO of Fifth Wall, pointed out in a recent interview (see best listens below), the traditional one-directional flow of energy from centralized power plants to buildings is no longer sustainable. The real estate industry is now being asked to reimagine itself not just as a manager of physical space, but as a player in the energy landscape.

The opportunity? Turning buildings and the built environment (parking structures and more) into power plants and owning the asset.

By integrating onsite energy solutions—solar panels, battery storage, electric vehicle infrastructure, wind, backup generators, microgrid controllers and more advanced technologies—building owners can significantly reduce their reliance on the grid (great for them and the grid - as it is overwhelmed), lower energy costs, and generate additional revenue and enterprise value. Revenue can be realized by selling energy to tenants, back to the grid, and in the future to anyone, charging more for premium amenities (clean, cheap, and reliable power), and/or leasing unused real estate (roofs/car parks) to energy developers. As Brendan mentioned, less than 3% of commercial rooftops currently have solar panels. Imagine the potential of the other 97%—rooftop real estate that could be monetized to generate clean, reliable power while increasing tenant satisfaction.

In 2016, the US National Renewable Energy Laboratory estimated that there are a little over 8 billion square meters of suitable roofs in the US. Cover that in solar panels, and we would produce about 1,400 terawatt hours of electricity each year. The total production is equal to nearly 40 percent of the total electricity currently sold by utilities in the U.S.! But the barriers to adoption remain significant. The primary barriers I often hear are:

Rising Energy Costs & Budgeting: Increasing utility costs and pressure to adopt onsite energy systems without pre-accounted-for expertise or capital.

Leasing Model Challenges: Triple-net leases create disincentives for energy upgrades, risking tenant retention.

Capital & Investment Uncertainty: Perceived high upfront costs and unclear ROI on energy-related investments.

Lack of Expertise: Limited energy know-how, resource-constrained teams trying to do more with less, and a strong desire to stay focused on “core business”.

Climate Risks: Increasing property vulnerability to climate events and insurance costs - risking stranded assets.

ESG & Sustainability Demands: Compliance with decarbonization and tenant sustainability expectations while facing fines for non-compliance.

Technology Gaps: Inadequate technology infrastructure.

I will cover each of these in more detail in future articles, but for today, I really want to dig into the opportunity.

The Asymmetric Risk Opportunity

Properties that are energy-optimized can realize an asymmetric risk opportunity, never before possible, this truly is an opportunity of a generation:

Boost Property Value with Lower Operating Costs

What do utility bills have to do with property values? Well, utility bills are a key operating expense (typically 5-40% for any C&I business - not inconsequential to the bottom line and increasing!), and when you cut them with onsite energy, you drive your NOI higher. Let’s break it down.

Revenues - Operating Expenses = NOI

In commercial real estate, your NOI directly influences your property value. By reducing your utility costs, you proportionally increase your NOI.

Added Property Value = Annual Savings / Cap rate

If you cut your operating costs, you can increase your property value.

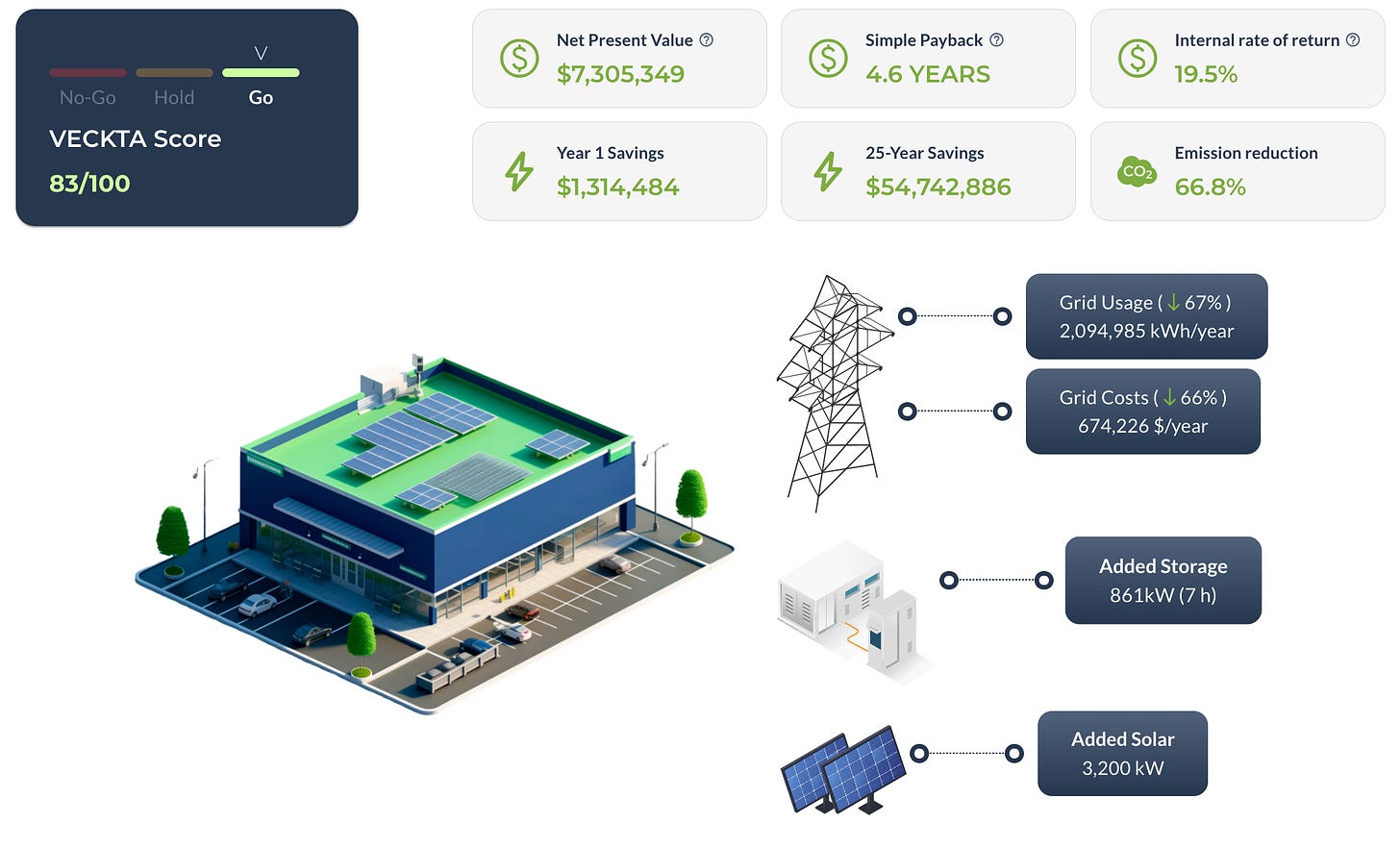

Here’s an example: We recently completed the analysis for a Self Storage Company that will save >$300,000 in energy costs by installing solar and batteries at 13 facilities, in the first year, and based on today’s utility prices! At an assumed 5% cap rate, that translates into an added property value of $6 million.

Studies have found that the resale value of a commercial property with solar (plus) often fetches 10-30% more than comparable properties without solar installations.

New Revenue

Traditionally, tenants cover the cost of their utilities, but what if property owners turned this opportunity into a new revenue stream? With onsite energy, that’s exactly what can happen. In certain states, property owners can charge tenants for the energy they consume from onsite systems. You can redirect the payment from the tenant to the utility to you, the property owner. With technologies like Ivy Energy, this is increasingly easy to manage. In some instances, building owners can sell the energy generated onsite back to tenants at a rate lower than what traditional utilities offer - even if the rate is the same as today but locked in, the risk mitigation to escalating rates is huge. This gives tenants reduced operating costs, freeing up more cash flow to invest in growing their business. This strengthens the tenant relationship, likely extends/secures leases, and makes the property more attractive to existing or future tenants.

Also worth considering are opportunities to explore new tenant agreements “outside the box” but on your property. If you have excess energy (you are a large warehouse with huge energy-generating potential but low energy needs), you can explore off-takers for the energy generated onsite, such as EV charging hubs, bitcoin miners, data centers, etc., who will pay a premium for access to energy without the headaches of developing the solution themselves.

Real estate asset owners can also unlock a new revenue stream by generating energy onsite and selling carbon credits. When you install solar panels or other renewable energy systems, you reduce your property’s carbon footprint. In turn, you can earn carbon credits for the emissions you’ve avoided. These credits can be sold in carbon markets to businesses and organizations seeking to offset their emissions. Carbon credits in 2023 cost $40 to $80 per metric ton of CO2 or equivalent GHG emissions. However, carbon pricing can fluctuate greatly with demand.

Financial Incentives

The government will reward you to invest in your own infrastructure, do not leave this money on the table. Let’s break it down:

Federal Tax Credits - The Inflation Reduction Act (IRA) offers significant tax incentives for clean energy investments, including a 30% federal tax credit for solar/battery projects, which can increase to 40% or more if certain criteria are met, such as using U.S.-manufactured equipment or locating projects in disadvantaged/energy communities. These credits can be applied directly to reduce tax liabilities, providing substantial savings and making investments even more financially attractive. Investing $1 million in an onsite energy project entitles you to, at minimum, a $300,000 reduction in your tax bill. Unlike a deduction, which reduces your taxable income, a tax credit offers a dollar-for-dollar reduction in the amount of tax you owe, which can be applied either this year or carried forward to future years. Alternatively, you can sell the credits for approximately 90c on the dollar.

Depreciation - onsite energy projects are eligible for accelerated depreciation, allowing you to write off the full cost of the project—minus half of the tax credit—over five years. For the example above, this could mean an additional $178,500 in tax savings. If you’re in states like New York or California, you could save an additional $61,000 to $75,000 in state taxes as well.

The bottom line, for a $1,000,000 investment in an energy project, you could benefit from an additional $553,000 tax benefit. You are investing in an incredible asset for half price!

Increase Lease Terms and Amounts

Think of energy and related benefits as a premium amenity for your property, which many companies will pay for. Examples include:

Sustainability - Over half of Fortune 500 companies have committed to reducing their carbon footprint (yet the CDP indicates less than 0.4% of corporations have a credible energy transition plan), and they are actively seeking real estate and solutions that align with these sustainability goals. Installing onsite energy systems not only boosts the property's appeal but also enhances its marketability to these environmentally conscious tenants. According to the International Energy Agency (IEA), commercial properties with green credentials attract higher-quality tenants and can command up to 10% higher rents. What’s more, as the real estate owner, there is an opportunity to share the costs of the capital investment. More tenants, especially those with long-term leases, will co-invest in the infrastructure in return for sustainability and cost benefits. These are called green leases.

Resilience - The same rings true for energy resilience, particularly for tenants with high uptime needs. As the grid becomes increasingly vulnerable, the cost of energy security and reliability will become a premium. The cost to businesses due to power outages exceeds $150B per year in the U.S. alone and is only increasing - especially with examples like the recent hurricanes in the southeast where power was out for millions of customers.

EV Infrastructure - amenities like EV charging infrastructure will be increasingly expected by tenants. In 2023, EVs accounted for 18% of all cars sold, up from 14% in 2022. California has the highest number of EVs, with Florida and Texas following.

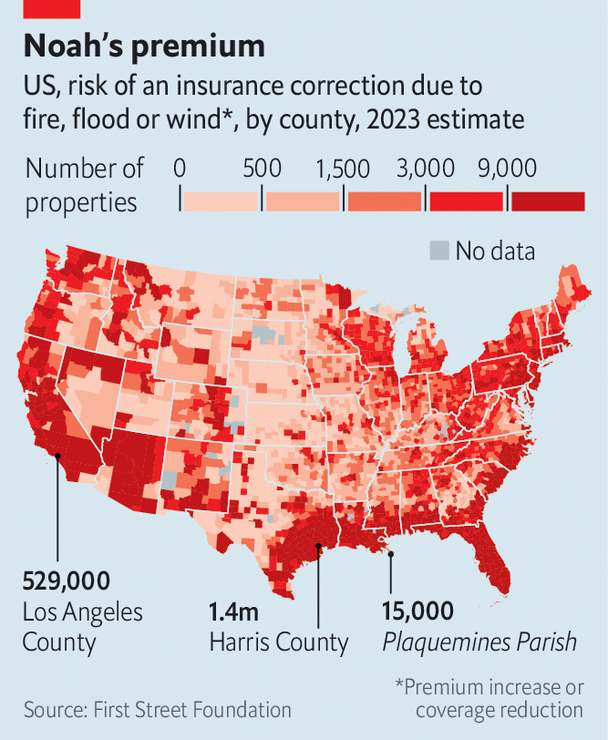

Mitigate Risks

As severe weather events become more prevalent, physical risks to real estate assets are becoming more tangible. Whether it's hurricanes, floods, or wildfires, climate-related events are no longer rare anomalies—they are becoming part of our daily reality. In regions particularly vulnerable to these events, insurance premiums are rising, and in some cases, insurance coverage is becoming difficult to obtain.

For real estate asset owners, this is a risk. Weather risk is now a financial risk, and properties that are not built or retrofitted to withstand these events will lose value. In a recent conversation with Brendan McCarthy - Head of Real Estate Sustainable Investment at Calvert Research and Investment, he noted that proactive owners who invest in “climate-resilient buildings” are protecting their assets and ensuring long-term profitability and viability. Those who are not proactive risk losing tenants and revenue and owning stranded assets that can not be insured.

Other Benefits

Beyond these direct benefits, there are additional benefits that may be harder to quantify but should not be overlooked when assessing investments:

Higher quality and cheaper capital

Attracting quality investors

Attracting and retaining top talent

Brand

Legacy

Summary

To succeed in this new era of real estate, asset owners can shift their mindset from managing costs to creating enterprise value through energy generation and decarbonization. This doesn’t mean abandoning traditional metrics like NOI, but rather enhancing them by considering long-term asset value, resilience (business, physical, operational), tenant partnerships, and environmental impact.

Collaboration and efficient execution is key. Asset owners must work closely with tenants, investors, and energy experts. There are many ways to turn perceived challenges into profitable opportunities. To learn more about how to develop projects efficiently and avoid pitfalls, check out this guide. My personal mission is to support more businesses to act with confidence to achieve incredible outcomes.

This truly presents an asymmetric risk opportunity. When developed well, onsite energy assets create high returns on investment with capped downside risk. Investing in optimized onsite energy assets improves financial returns and future-proofs portfolios in a dynamic environment. While immediate returns and benefits are viable for all parties, this strategy truly aligns with the real estate industry’s long-term growth strategies, making it an attractive alternative to traditional acquisition-focused investments with low yields.

Power Picks

Best Read: Guide to Onsite Energy Development

Best Listen: Brendan Wallace Interview - Onsite Energy as a Profit Center for Commercial Real Estate Owners

Best Watch: Operational Resilience During Extreme Weather

Power Moves

Don’t wait to be disrupted by rising costs, regulatory pressures or stranded assets that are hard to lease to force your hand. By proactively optimizing your energy strategy, you can position your properties for higher returns and greater long-term resilience. Explore how energy efficiency, solar, batteries, and more advanced energy solutions can turn your assets into profit centers, ensuring that your portfolio thrives now and for the long term.